I dare you to tell Ghanaians what you know about the death of Ebony and Vybrant Faya – Fmr. friend of Shatta Wale

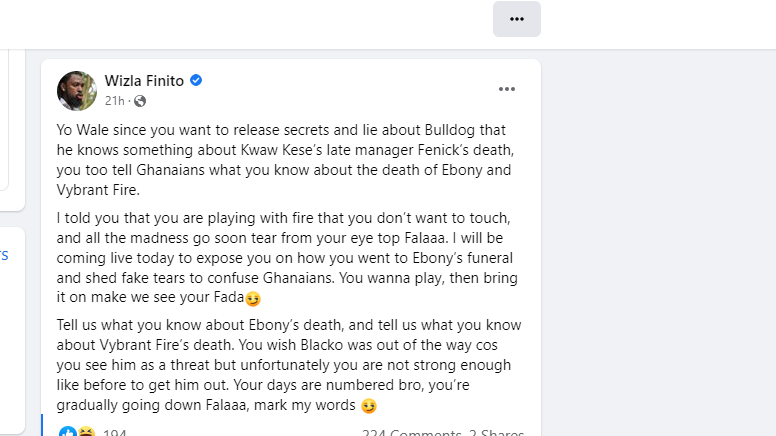

Shatta Wale’s former friend Wizla wrote on his page;

“Yo Wale since you want to release secrets and lie about Bulldog that he knows something about Kwaw Kese’s late manager Fenick’s death, you too tell Ghanaians what you know about the death of Ebony and Vybrant Fire.

I told you that you are playing with fire that you don’t want to touch, and all the madness go soon tear from your eye top Falaaa. I will be coming live today to expose you on how you went to Ebony’s funeral and shed fake tears to confuse Ghanaians. You wanna play, then bring it on make we see your Fada![]()

Tell us what you know about Ebony’s death, and tell us what you know about Vybrant Fire’s death. You wish Blacko was out of the way cos you see him as a threat but unfortunately, you are not strong enough like before to get him out. Your days are numbered bro, you’re gradually going down Falaaa, mark my words ![]() “.

“.

Check the post below;